- TALLY 7.2 INTEREST CALCULATION HOW TO

- TALLY 7.2 INTEREST CALCULATION SERIAL NUMBER

- TALLY 7.2 INTEREST CALCULATION UPGRADE

It automatically populates a lot of data to make sure the return is error free. It easily integrates with Tally, Excel & other accounting software.You can import invoice level data for Sales & Purchase in the cleartax GST and then it will calculate the data points to be filled on various GSTR forms.

In case you want assistance only in terms of filing returns ,then you can use ClearTax GST.

TALLY 7.2 INTEREST CALCULATION HOW TO

To understand how to create sales invoice in cleartax GST software, refer to the guide on Creation of Invoices. You can also create invoices using Cleartax Billbook. To change this date, press F2 from your keyboard or click on Date button provided at the right. Tally will show you the date of last voucher entry in the payment voucher screen. Gateway of Tally> Accounting Voucher>F5 Payment. Click F1: To view the detailed tax break-up.In the sales invoice, press Alt+P to print the invoice in the required format.For multiple copies: Press Alt+P and then Alt+C to select the number of copies. How to change the date of a voucher in Tally erp 9. View GST details You can view the tax details by clicking A: Tax Analysis. Step 5.In case of local sales, select the central and state tax ledger.If it is interstate sales,select the integrated tax ledger.ĭepending on your requirements, you can include additional details in your invoice by clicking F12: Configure such as buyer’s order no,delivery note no etc. Select the required items, and specify the quantities and rates. If it is local sale ,then select sales ledger for local taxable sales and if it is interstate sale,then select the sales ledger for interstate sales. In Party A/c name column, select the party ledger or the cash ledger.

TALLY 7.2 INTEREST CALCULATION SERIAL NUMBER

Step 1.Go to Gateway of Tally > Accounting Vouchers > F8 Sales.For invoice no, write the serial number of the bill. Steps to Create Sales Invoice in Tally.ERP 9 Release 6 for GST Under Party account,you must also mention whether the party is composite dealer, consumer, registered or unregistered dealer. You must create the following types of sales ledger and fill the related information required to create these ledgers : Tally 7.2 Silver or Tally 7. Tally eis v5.4 Release 6, Tally 7.2 software and activation crack, crack for tally 7.2.

TALLY 7.2 INTEREST CALCULATION UPGRADE

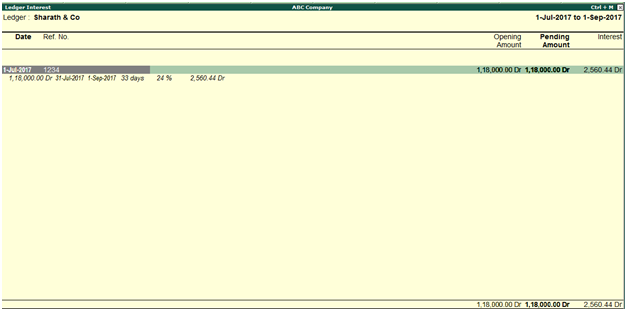

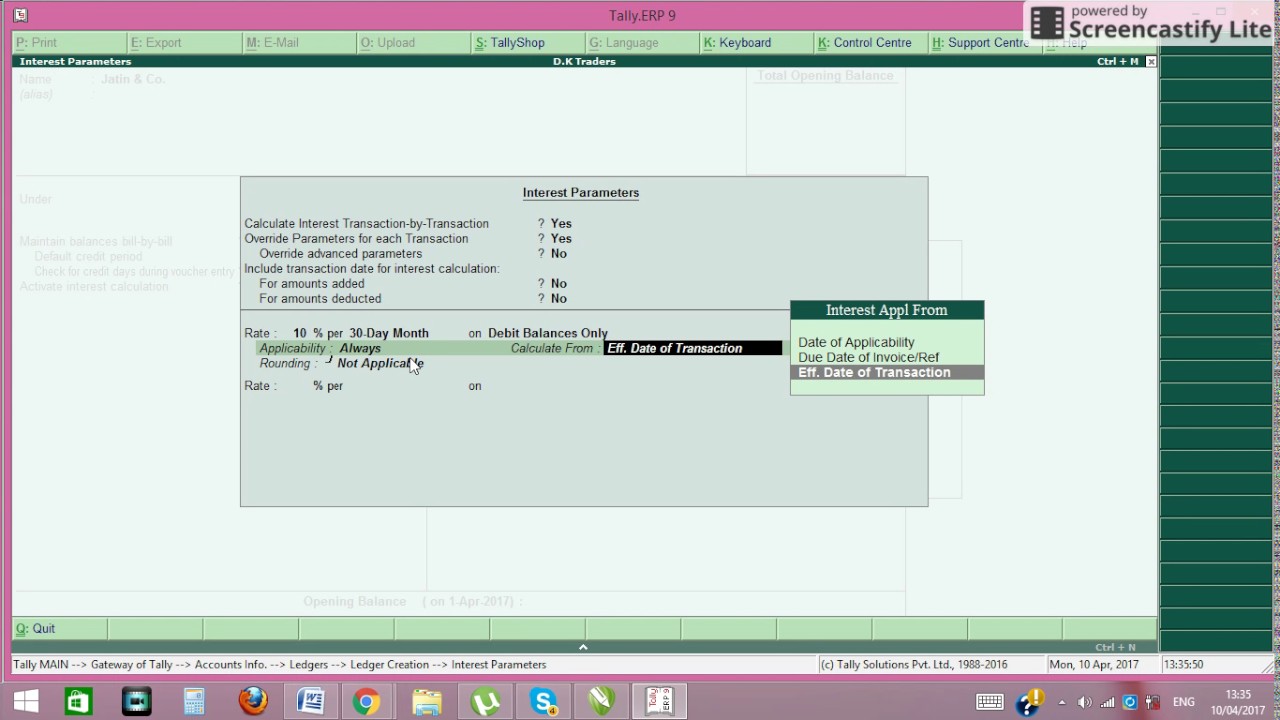

Let’s first understand the creation of Ledgers Ledger Creation Tally 7.2 users can upgrade to Tally 8 for Rs 2,000 and Rs 4,500 for single and multi-user editions respectively.

In this article we will explain you how to record Sales invoice in Tally release.ERP 9 Release 6 for GST. Use Tally for Accounting, ClearTax for GST Many GST compliant softwares are available in the market such as Cleartax, Tally etc. Recording transactions in the right manner is important for claiming the right ITC (Input Tax Credit). Many people are looking for the clarifications on how to record the transactions under GST in accounting softwares. With the GST rollout, it is very important for the businesses to keep themselves GST compliant.

0 kommentar(er)

0 kommentar(er)